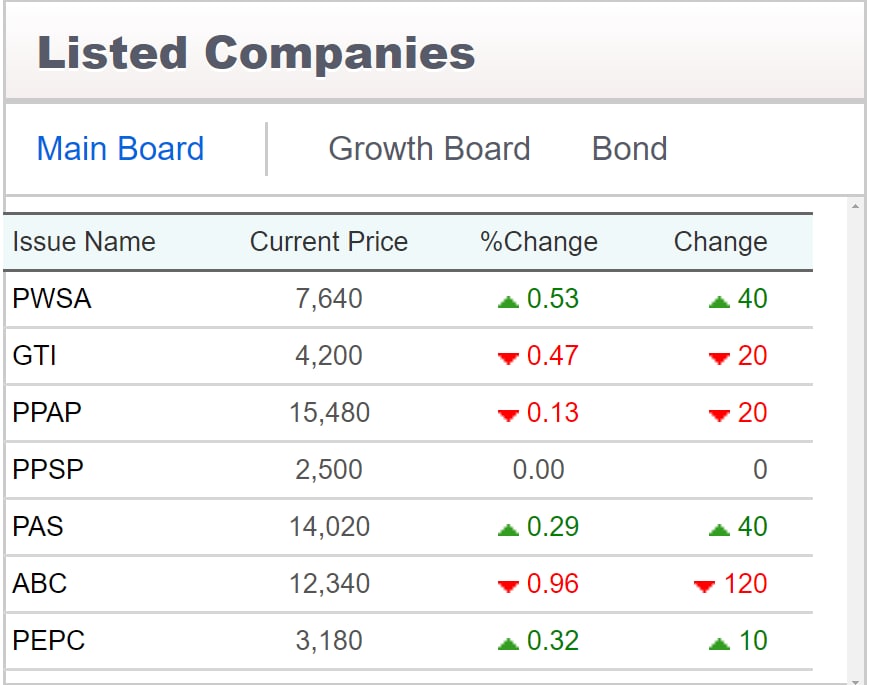

INTERNATIONAL: Let’s have a look at today’s finance. The CSX Index is currently at 535.24 Points down 3.04 Points or 0. 0.56%

The Daily Exchange Rate: is 4,045 KHR to the USD$

Now a look what else is happing in finance around the world.

FOUR EU CONTRIES ANOUNCE 80 BILLION MEASURES:

Four European Union countries have announced measures worth more than 80 billion euros to shield consumers and businesses from soaring energy prices exacerbated by the ongoing Russia-Ukraine conflict.

France, Germany, Italy and Spain are cutting taxes or funding rebates on fuel, electricity and natural gas.

France is introducing a 0.15 euro-per-liter rebate on transport fuel until July.

Germany's plan includes a three-month cut in fuel prices by 0.3 euro per liter for petrol and 0.14 euro for diesel.

Italy said in February it would spend about 6 billion euro on helping cut levies on energy bills.

Spain's 16-billion-euro "shock plan" will take effect this month, and last for the next three months. The government will subsidize fuel prices by 0.2 euro a liter, and provide 450 million euros in direct aid for transport companies.

U.S STOCK DOWN:

U.S. stocks closed lower yesterday after a session which saw all three benchmarks slip between positive and negative territory, as investors contrasted Bank of America's positive earnings with surging bond yields ahead of further earnings cues this week.

Trading volumes were thin after the Easter break: 10.35 billion shares changed hands, compared with the 11.79 billion averages for the full session over the last 20 trading days.

With European markets also remaining shut on Monday, this listless trading contributed to the topsy-turvy session.

"The market is looking for some direction. Do we get it from earnings - maybe? But the overarching factors continue to be what does China look like with its zero-COVID policy, and what does the Fed look like going forward in terms of interest rates and inflation."

ROUBLE STEADY:

And with The rouble briefly firmed past the 79 mark against the dollar on Monday, while stock indexes fell as the market lacked new momentum and investors watched developments around what Russia calls "a special military operation" in Ukraine.

By 1114 GMT, the rouble had gained 1.1% to 79.10 against the dollar after briefly touching 78.80, its strongest since April 12. Against the euro, the rouble firmed 3.3% to 82.60, a level last seen on April 8.

This week the rouble is expected to trade within the range of 79-82 to the dollar and 84-87 to the euro, Rosbank analysts said in a note.

The rouble can encounter some downside pressure from the central bank, which is expected to lower its key rate from 17% at its next board meeting on April 29.

This month, the rouble could see support from tax payments as companies are due to pay a record 3 trillion roubles ($37.50 billion) in taxes, for which some export-focused companies need to sell foreign currency, according to analysts

YEN DROPS:

Then we go to the yen and nothing is stopping its slide, the yen has fallen to a 20 year low against the dollar.

The dollar rose 0.37% on the yen to 127.44 yen in early trade, its highest level since May 2002.

It has risen 4.5% on the Japanese currency so far this month, which would be its second-biggest monthly percentage gain since 2016 behind March's 5.8%.

The dollar was also firm against most other currencies and the dollar index was at 100.8, just off Monday's two-year high of 100.86.

Japan is watching how the weakening yen may affect the economy, as stability in the currency market was important, Finance Minister Shunichi Suzuki said on Tuesday, reiterating earlier remarks by several politicians and officials.

The euro was at $1.0776, testing last week's two-year low of $1.0756, and sterling was also soft at $1.3006, not helped by the latest fighting in Ukraine.

Elsewhere, the Australian dollar edged up from Monday's one-month low and was at $0.7355.

Bitcoin also managed to find its feet, trading around $40,800 on Tuesday after hitting a one-month low of $38,547 on Monday.